Escrow costs are prorated based on a specific time period, ensuring a fair distribution of expenses between buyers and sellers in real estate transactions. This practice involves calculating and dividing these costs proportionally, based on the number of days each party holds ownership of the property during the settlement period.

Prorating escrow costs is crucial for ensuring transparency and equity in real estate transactions. It helps to allocate expenses accurately, preventing any party from bearing a disproportionate financial burden.

Escrow Costs and Proration

Escrow costs are expenses associated with a real estate transaction that are typically paid at closing. These costs can include title insurance, lender fees, and attorney fees. In some cases, escrow costs may be prorated, meaning that they are divided between the buyer and seller based on the number of days each party owned the property during the escrow period.

The purpose of prorating escrow costs is to ensure that each party pays their fair share of the expenses. For example, if the buyer takes possession of the property on the 15th of the month, they would be responsible for paying 15/30 of the monthly escrow costs.

The seller would be responsible for paying the remaining 15/30 of the costs.

Examples of Escrow Costs That May Be Prorated

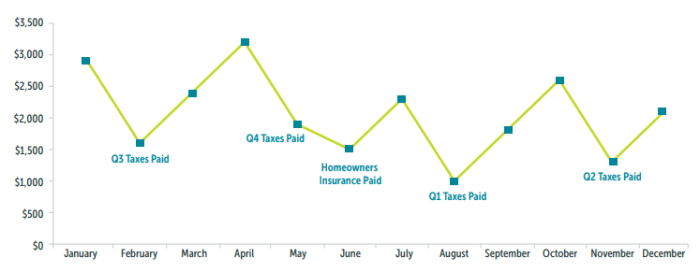

- Property taxes

- Homeowners insurance

- Mortgage interest

- Private mortgage insurance (PMI)

- Hazard insurance

- Flood insurance

Impact of Proration on Buyers and Sellers

Proration allocates expenses between buyers and sellers based on the number of days each party owns the property during the billing period. This process impacts financial obligations, closing costs, and negotiation strategies.

Impact on Financial Obligations

Proration ensures that both parties pay a fair share of expenses incurred before the closing date. Buyers are responsible for expenses from the closing date onward, while sellers cover expenses up to that point. This includes property taxes, insurance premiums, and HOA fees.

Impact on Closing Costs

Prorated expenses are typically included in closing costs. Buyers may pay a higher portion of closing costs if they close towards the end of the billing period, while sellers may pay more if they close near the beginning.

Negotiation Strategies

Negotiating proration terms can help buyers and sellers minimize their financial obligations. Buyers can request a lower proration amount for expenses they will not benefit from, such as property taxes paid by the seller before the closing date. Sellers can request a higher proration amount for expenses they will continue to incur after closing, such as HOA fees.

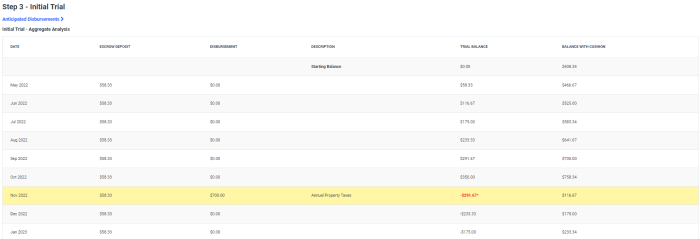

Proration Calculations

Proration calculations determine the amount of escrow costs that each party (buyer and seller) is responsible for paying at closing. These costs are typically prorated based on the number of days each party will own the property during the current billing cycle.

Formula for Prorated Escrow Costs, Escrow costs are prorated based on a

The formula for calculating prorated escrow costs is:“`Prorated Escrow Costs = (Total Escrow Costs

Number of Days Owned) / Number of Days in Billing Cycle

“`

Example Table of Prorated Escrow Costs

The following table shows an example of how prorated escrow costs are calculated:| Item | Total Escrow Costs | Number of Days Owned by Seller | Number of Days Owned by Buyer | Prorated Escrow Costs for Seller | Prorated Escrow Costs for Buyer ||—|—|—|—|—|—|| Property Taxes | $1,200 | 180 | 185 | $900 | $300 || Homeowners Insurance | $600 | 180 | 185 | $300 | $300 || Mortgage Interest | $1,000 | 180 | 185 | $500 | $500 ||

- *Total |

- *$2,800 |

- *180 |

- *185 |

- *$1,700 |

- *$1,100 |

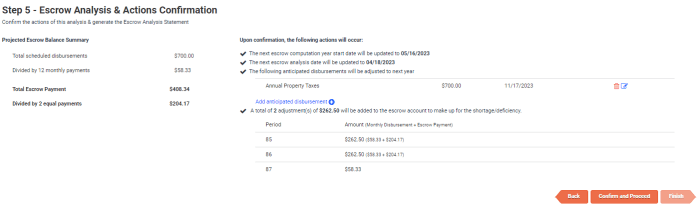

Adjustments for Prepaid Items

If any escrow items have been prepaid by the seller, such as property taxes or homeowners insurance, the proration calculation must be adjusted to account for this. The adjustment is made by subtracting the amount of the prepaid item from the total escrow costs before calculating the prorated amount.For

example, if the seller has prepaid $200 of property taxes, the total escrow costs would be reduced to $2,600 before calculating the prorated amount. This would result in a prorated escrow cost for the seller of $800 and a prorated escrow cost for the buyer of $400.

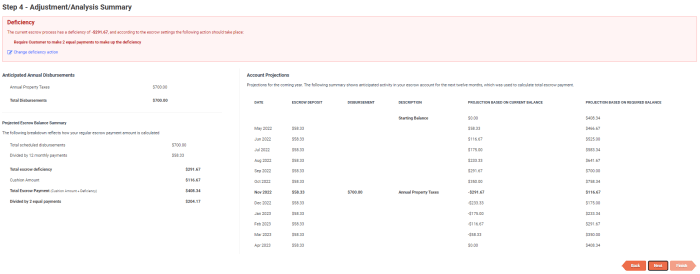

Escrow Disbursement and Proration

Escrow disbursement refers to the process of distributing the funds held in escrow to the appropriate parties upon the closing of a real estate transaction. Proration plays a crucial role in determining the distribution of these funds.

Proration in Escrow Disbursement

Proration involves dividing expenses and credits between the buyer and seller based on the number of days each party owned the property during the settlement period. This ensures that each party is responsible for their proportionate share of expenses incurred during their ownership period.

For example, if the seller owned the property for 180 days and the buyer for 120 days during the settlement period, the seller would be responsible for 60% of the property taxes due for the year, while the buyer would be responsible for 40%.

Escrow Disbursement Statement

An escrow disbursement statement is a document that details the distribution of escrow funds. It typically includes the following information:

- Purchase price

- Down payment

- Loan amount

- Closing costs

- Prorated expenses (e.g., property taxes, insurance premiums)

- Net proceeds to seller

The escrow disbursement statement provides a clear breakdown of how the escrow funds were allocated and disbursed.

Best Practices for Proration: Escrow Costs Are Prorated Based On A

Proration is a crucial aspect of real estate transactions, ensuring a fair and equitable distribution of costs between buyers and sellers. To achieve this, it is essential to adhere to best practices that minimize potential pitfalls and ensure a smooth process.

Identifying Potential Pitfalls

Before embarking on the proration process, it is important to identify potential pitfalls that can lead to disputes and dissatisfaction. These include:

Inaccurate calculations

Errors in calculating prorations can result in incorrect distribution of costs, leading to financial discrepancies.

Lack of transparency

If the proration process is not transparent, parties may not fully understand the basis for cost allocation, leading to mistrust.

Unfair distribution

Prorations should be based on equitable principles, ensuring that both buyers and sellers bear their fair share of costs.

FAQs

What are escrow costs?

Escrow costs are fees and expenses associated with a real estate transaction that are held in a neutral third-party account until the closing date.

Why are escrow costs prorated?

Escrow costs are prorated to ensure that both the buyer and seller pay their fair share of expenses based on the time they own the property during the settlement period.

How are prorated escrow costs calculated?

Prorated escrow costs are calculated by multiplying the total escrow costs by the number of days each party owns the property during the settlement period, divided by the total number of days in the settlement period.